Letter from the CEO

I’d like to invite you to read the 2024 Annual Report of the Bank Handlowy w Warszawie S.A. Capital Group

Strong operating results of the Bank

net

profit (PLN)

1.8 bn

high cost effectiveness,

C/I ratio

35%

increase in loan

volumes

6% YoY

TLAC TREA

ratio

24,4%

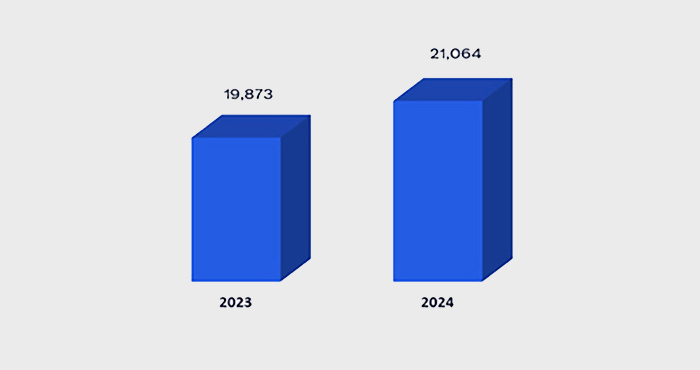

Loan volumes (PLN MM)

-

-

Financial statements 2024

- Consolidated income statement

- Consolidated statement of comprehensive income

- Consolidated statement of financial position

- Consolidated statement of changes in equity

- Consolidated cash flow statement

- Additional information including the description of adopted accounting principles and other explanatory information

-

Report on activities

- Poland’s economy in 2024

- Organizational structure of the Capital Group of Bank Handlowy w Warszawie S.A.

- Selected financial data of the Capital Group of Bank Handlowy w Warszawie S.A.

- Significant risks related to the activities of the Capital Group of Bank Handlowy w Warszawie S.A.

- Sustainability Statement for 2024

- The Bank’s community initiatives and cultural sponsorship

- Investor information

- Statements of Bank Handlowy w Warszawie S.A. concerning the application of corporate governance standards in 2024

- Other information about the authorities of Bank Handlowy w Warszawie S.A. and corporate governance rules

- Agreements concluded with the registered audit company

- Statement of the Bank’s Management Board

-

-

-

Auditor’s Opinion

-

-

Creating value for shareholders

- • ROE: 21.1% - (vs. 15,7% in banking sector) - above the cost of capital and inflation

- • ROA: 2.4% (vs. 1.3% in banking sector)

- • capitalization: PLN 11.6 bn

- • dividend yield: 10.2% - one of the highest in the banking sector

-

Maintaining strong revenues in Institutional Banking

- • increase of loan volumes by 8% YoY

- • volume of long-term loans granted in 2024: PLN 2.1 B, +31% YoY

- • increase in value of trade financing transactions by+58% YoY

- • increase in FX volume by +4% YoY

-

Continuation of growth in the strategic areas of Consumer Banking

- • record high number of the most affluent clients (Citi Private Client - CPC) - increase by 7% YoY, increase in the number of CitiGold clients by 9% YoY

- • increase in individual clients' deposits by 5% YoY

- • increase in investment product volumes by 17% YoY

Sustainability

-

Environmental:

- achieving the strategic goal of acquiring PLN 1 billion of "green assets" - nearly PLN 1.3 billion acquired in 2022-2024

- credit policy – incorporation of environmental and social factors in credit processes

- achieving 100% of the goal for 2022-2024 in terms of reducing the carbon footprint from own activities and reducing energy consumption

- taking further steps to achieve climate neutrality in own activities (scope 1 and 2) by 2030 - modernization of the bank's headquarters at Senatorska Street

-

Social

- social involvement - Citi volunteers in Poland reached out to over 20,000 people in need - social welfare homes, orphanages and refugees

- promoting and supporting employee initiatives - Citi Women Network, Disability Network, Citi Pride Network, charity activities or joint sports activities – Live Well at Citi

- diversity supporting - maximum result in the ranking of institutions with professional and social equality of LGBT+ people organized by Cashless.pl

-

Governance

- maintaining position of the leader of diversity - women represents 43% of the Bank's Management Board and 37% of the Supervisory Board, which is confirmed by the distinction "ESG Eagles" of the Rzeczpospolita daily

- the title of "Ethical Company" in the Puls Biznesu study.